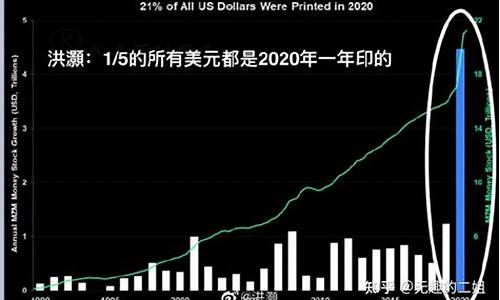

As the global economy continues to grow and develop, the threat of inflation looms large. Inflation is defined as an increase in the price of goods and services over a period of time, and it can have significant impacts on individuals, businesses, and entire economies.

If you are concerned about the possibility of inflation affecting your finances or investments, there are several steps you can take to prepare yourself. Here are some tips for how to respond to the potential impact of inflation:

1. Keep track of prices: One of the best ways to prepare for inflation is to keep track of prices for items you regularly purchase. By monitoring prices over time, you can get an idea of how much things may cost in the future and adjust your spending accordingly.

2. Diversify your investments: Another way to protect yourself from inflation is to diversify your investment portfolio. This can include holding assets that tend to perform well during times of inflation, such as real estate or commodities.

3. Consider alternative savings vehicles: If you are worried about the impact of inflation on your savings accounts or other traditional savings vehicles, you may want to consider alternative options such as high-yielding bonds or money market funds.

4. Be prepared for changes in your budget: As inflation rises, you may need to make adjustments to your budget in order to accommodate the increased cost of goods and services. This could mean cutting back on discretionary spending or finding ways to save on everyday expenses like groceries or transportation.

5. Stay informed: Finally, it's important to stay informed about economic trends and developments that could impact inflation. This can involve reading financial news and analysis, attending seminars or workshops on personal finance, or consulting with a financial advisor.

By taking these steps to prepare for the potential impact of inflation, you can help ensure that your finances and investments are protected in an increasingly uncertain economic climate.