Title: Understanding Digital Currency Payments: The Form and Function

Digital currency payments have become increasingly popular in recent years, with more and more people embracing this new form of payment. But what exactly are digital currency payments, and how do they work? In this article, we will explore the forms and functions of digital currency payments, including their advantages and limitations.

The Forms of Digital Currency Payments

Digital currency payments can take many different forms, depending on the specific platform or application being used. Some common forms of digital currency payments include:

1. Cryptocurrencies: Cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are perhaps the most well-known form of digital currency. They operate using a decentralized network, allowing for secure and anonymous transactions. Transactions are recorded on a public ledger called the blockchain, which ensures transparency and security.

2. Stablecoins: Stablecoins are cryptocurrencies that are pegged to the value of a traditional asset, such as the US dollar. This provides stability and reduces the volatility associated with other cryptocurrencies.

3. Decentralized Finance (DeFi) Apps: DeFi apps use smart contracts to facilitate financial transactions without the need for intermediaries such as banks. These apps often allow users to earn interest on their digital assets, borrow money, or trade assets directly with one another.

The Functions of Digital Currency Payments

Digital currency payments function similarly to traditional payments, but with some important differences. Here are some key functions of digital currency payments:

1. Security: One of the biggest benefits of digital currency payments is their security. Transactions are recorded on a public ledger called the blockchain, which ensures transparency and prevents double-spending. Additionally, digital currencies often use advanced encryption techniques to protect user data.

2. Speed: Digital currency payments can be completed almost instantly, making them ideal for online transactions. This is especially true for smaller transactions, where traditional banking processes can be slow and cumbersome.

3. Cost-effectiveness: Digital currency payments can be more cost-effective than traditional bank transfers, particularly for international transactions. This is because digital currencies avoid the fees associated with wire transfers and other forms of international money transfer.

Limitations of Digital Currency Payments

Despite their many advantages, digital currency payments also have some limitations that should be considered. Here are some key limitations:

1. Limited Acceptance: While digital currencies are becoming more widely accepted, they are still not as widely accepted as traditional forms of payment. Many merchants and service providers still prefer to accept traditional forms of payment due to concerns around security and regulatory compliance.

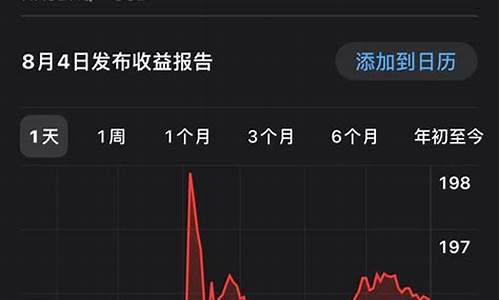

2. Volatility: As with any form of investment, digital currencies can be volatile and subject to price fluctuations. This means that investors should carefully consider the risks before investing in digital currencies.

Conclusion

In conclusion, digital currency payments represent an exciting new frontier in the world of finance. While they have their limitations, their many advantages make them an attractive option for both consumers and businesses alike. As digital currencies continue to evolve and mature, it will be interesting to see how they continue to transform the way we think about money and finance.